- #Depreciation calculator how to

- #Depreciation calculator Pc

The most widely recognized devaluation is straight-line deterioration, taking a similar measure of deterioration every extended period of the resource's valuable life.įor instance, the primary year estimation for a resource that costs $15,000 with a rescue worth of $1,000 and a helpful existence of 10 years would be $15,000 less $1,000 isolated by 10 years rises to $1,400.

#Depreciation calculator how to

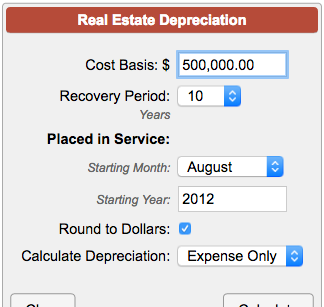

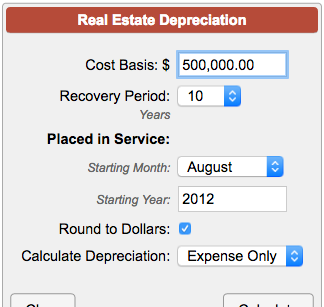

You can track down the helpful life (called "recuperation period" for charge motivations behind) explicit business resources in Publication 946 How to Depreciate Property.ĭevaluation is determined every year for charge purposes.

The rescue esteem toward the finish of its valuable life. The helpful existence of the resource (likewise called the recuperation time frame). The expense of the (resource premise), including costs for purchasing the resource, delivery, arrangement, and preparing. To work out deterioration, you want to know: The Most Effective Method to Calculate Depreciation You can take a derivation for deterioration of $800 every year on your business government form. #Depreciation calculator Pc

The normal PC keeps going 10 years, so it diminishes in esteem by 10% every year. Suppose you bought a piece of PC gear for your business at the expense of $8,000. The Internal Revenue Service (IRS) calls this kind of property (like vehicles, apparatus, hardware, and furniture) capital resources. Balance Formula with Double Declining = 2 X Cost of the asset/Useful LifeĪt the point, when your business purchases property for long haul use, you can take derivations for the expense of the property by spreading it for more than quite a while utilising an interaction called devaluation.

Formula for the double declining balance method is = 2 X Cost of the asset & Depreciation rate.The depreciation amount will be as follows: The devaluation cost will be lower later when contrasted with the straight-line strategy for deterioration.

The resource will deteriorate by a similar sum as it may, it will be discounted higher in the early long periods of its valuable life.

Nonetheless, sped up devaluation doesn't imply that the deterioration cost will likewise be higher. Since the devaluation is done at a quicker rate (two times to be exact) of the straight-line strategy, it is called sped up deterioration. A double-declining balance strategy is a sped-up devaluation technique wherein the resource esteem deteriorates double the rate done in the straight-line technique. The deduction of depreciation expenses every year can reduce your tax bill as a small business owner.ĭon’t worry, our depreciation rate calculator is here to help you out with the easy calculation in seconds.ĭual Declining Balance Method is one of the sped-up techniques utilised for the estimation of the deterioration add up to be charged in the pay articulation of the organisation, and it is determined by increasing the Book worth of resource with Rate of devaluation according to straight-line strategy and 2.ĭouble Declining Balance Depreciation Method. For accounting and tax purposes, depreciation is calculated differently, but the basic idea remains the same. The fundamental way to calculate depreciation is to take the asset's price minus any salvage value over its useful life. The depreciation method is a way to spread out the cost of a long-term business asset over several years. So it's essential to comprehend the strategies for computing devaluation. How deterioration is determined decides the amount of a devaluation derivation you can take in any year. That sort of long haul derivation is called devaluation.ĭeterioration is characterised as the worth of a business resource over its useful life. Notwithstanding, charge guidelines say you should spread the payment of that resource over its valuable assessed life.

At the point, when your business purchases a resource (an actual property claimed by your organisation), you can deduct the expense of that resource as a cost of doing business.

0 kommentar(er)

0 kommentar(er)